|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

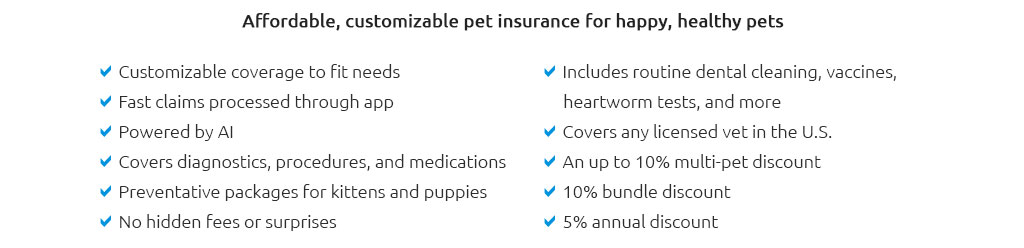

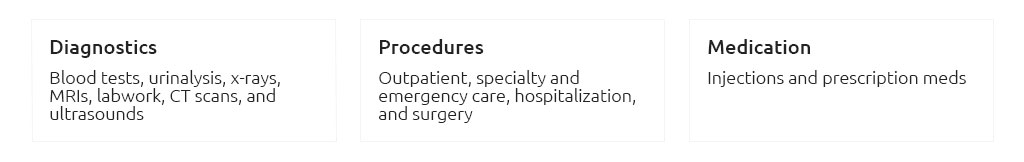

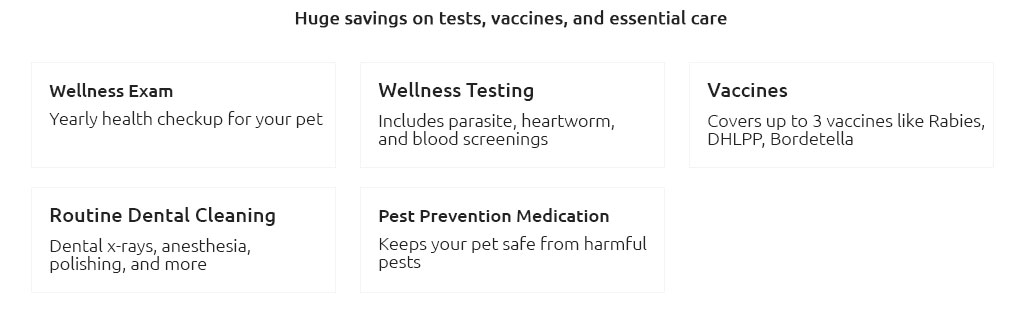

Understanding Pet Insurance: Choosing the Best for Your Furry FriendIn today's world, where pets are cherished family members, ensuring their health and well-being is paramount. One way to safeguard their future is through pet insurance, a concept that might seem daunting to many. However, selecting the best pet insurance can make a significant difference in your pet’s life, offering peace of mind and financial security. This guide aims to unravel the complexities of pet insurance, helping you make an informed decision. Firstly, let’s explore what pet insurance is and why it's crucial. Pet insurance functions similarly to human health insurance, covering a range of medical expenses for your pet, from accidents to illnesses. The primary benefit is the financial relief it provides during unexpected health crises, allowing pet owners to focus on their pet’s recovery rather than the cost. Why should you consider pet insurance? Veterinary care has evolved significantly, offering advanced treatments that, while lifesaving, can be quite expensive. With pet insurance, you can access top-notch care without financial strain. Furthermore, pets, much like humans, are susceptible to a myriad of health issues as they age, making insurance an invaluable investment in their long-term health. Now, how do you choose the best pet insurance? The first step is assessing your pet's needs. Different breeds have varying health predispositions; for instance, larger breeds may be prone to joint issues, while smaller ones might suffer from dental problems. Understanding these can guide you in selecting a policy that offers the best coverage for your pet’s specific needs. Next, consider the coverage options. A comprehensive policy typically includes coverage for accidents, illnesses, surgeries, medications, and sometimes even routine care like vaccinations and check-ups. However, not all policies are created equal. Some might exclude certain conditions or have limitations on coverage amounts. It’s crucial to read the fine print and compare different policies.

Customer reviews and ratings also offer valuable insights. Feedback from other pet owners can highlight an insurer’s reliability, customer service quality, and how hassle-free the claims process is. Opt for insurers with positive reviews and a reputation for transparency and prompt service. Moreover, some insurers offer additional benefits like wellness rewards programs, where you can earn points for preventive care activities that translate into discounts on premiums or future services. These programs can be an added incentive, promoting regular check-ups and vaccinations. Finally, consider lifetime coverage. Pets with chronic conditions require ongoing treatment, and lifetime coverage ensures these conditions remain covered throughout the pet’s life, providing continuous support without policy restrictions on renewals. In conclusion, while choosing the best pet insurance involves careful consideration and research, the effort is worthwhile. A well-chosen policy can be a lifeline during emergencies, allowing you to provide the best possible care for your beloved pet without financial worry. Remember, the best pet insurance is one that aligns with your pet’s health needs and your financial situation, offering comprehensive coverage and peace of mind as you enjoy countless happy moments with your furry friend. https://www.consumerreports.org/money/pet-insurance/is-pet-insurance-worth-it-a8622180631/

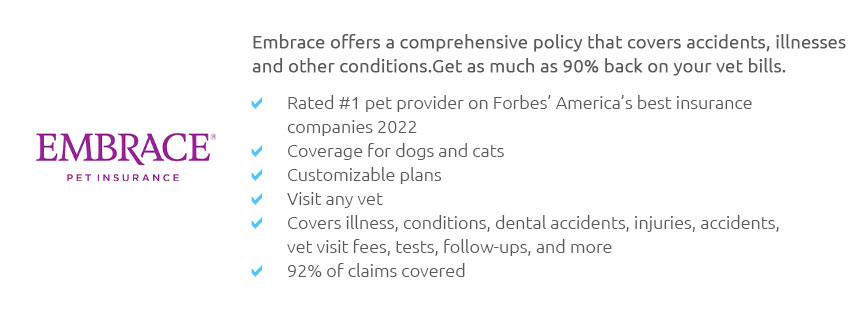

At Consumer Reports, we rated eight pet insurance providers: ASPCA, Banfield, Embrace, Fetch, Healthy Paws, Nationwide Pet Insurance, Pets Best, ... https://www.petsbest.com/

Pets Best offers pet insurance plans for dogs and cats covering up to 90% of your unexpected veterinary costs with no annual or lifetime payout limits and ... https://www.nokillcolorado.org/pet-insurance

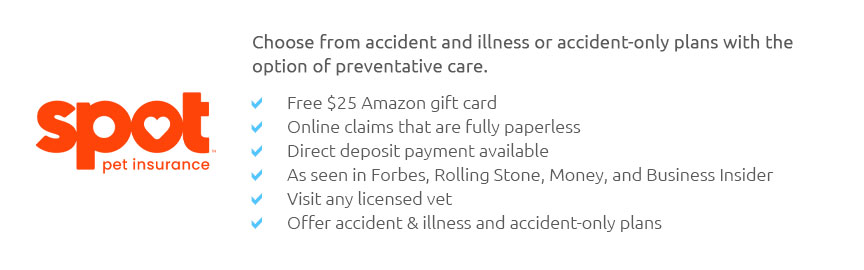

Pet Insurance - Insurance Companies - Lemonade - Pawp - Pumpkin Care - Vidaah - Spot - FIGO Pet Insurance - Compare Page.

|